The price of Green Coffee generally gravitates around the regulated futures exchanges which, for both Arabica and Robusta, used to operate with real-live humans in New York and London respectively but now exist virtually!

Arabica prices are quoted in US cents/lb and the standard contract refers to 37500 lbs of exchange certified arabica coffee (or 283.5 bags of 60 kg).

Robusta prices are quoted in USD/metric ton and the standard contract refers to 10000 kgs of exchange certified robusta coffee (or 166.67 bags of 60 kg).

Coffee pricing board at the Kenya coffee exchange

Market Participants

Many thousands of market participants, some of whom are actually involved with the physical commodity, but most of whom are not (other than as coffee drinkers), ensure that the futures markets maintain liquidity — i.e., at any one time, there are buyers to match the sellers — and the yearly traded exchange volume exceeds physical coffee consumption many times over.

The futures markets are used by physical coffee participants (coffee producers, traders and roasters) to manage their price risks and to act as a ‘sponge’ — soaking up excess production or releasing stocks when fresh beans are scarce.

The markets are also used by managed money and speculative funds seeking returns on capital. Within the last 30 years the total value of funds seeking investment returns has grown exponentially, and a very small percentage finds its way into the coffee markets.

“One of the main purposes of the future markets is to serve as a hedging mechanisms for producers,” noted Mauricio Jimenez, General Manager at Genuine Origin. “The reality is that, even in the 21st century, over 90% of the producers don’t have the means to hedge their price risk due to economies of scale, liquidity needs and misinformation.”

Price Volatility & Its Impact

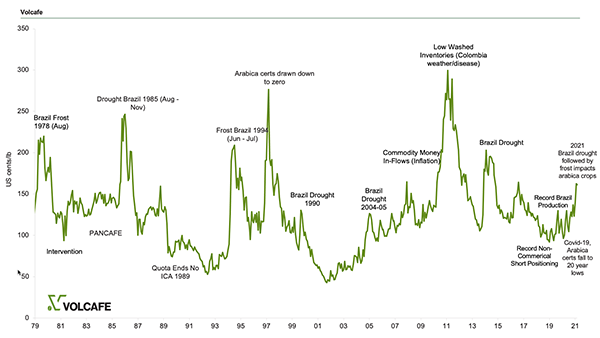

Over time, futures markets come to reflect the basic underlying economic principles of supply and demand, but often with spasms of price volatility which can be caused by disruptive shock events (eg — a frost in Brazil) resulting in large price swings in both directions as shown in the below chart.

Other macroeconomic factors can also determine longer term underlying trends. Global recession, for example, can indicate an overall reduction in consumption and hence initiate a move to lower price levels. Exchange rate movements in some important coffee producing origins, ie. Brazil, also have a significant correlation to the underlying futures prices

Unlike oil, coffee supply cannot be turned on and off like a tap. Periods of higher prices attract additional investment into production which generally takes two or more years to realize, resulting in a time-lagged price cycle which, together with natural on — off crop cycles, can accentuate market swings.

Green coffee price chart on Bloomberg Terminal

Differentials

The evolution of the regulated futures exchanges and its widespread use as a price risk hedging instrument for the commercial actors in the trade — ie. producers, traders and roasters — resulted in the development of the green coffee price differential — simply put, the difference between the outright price of the physical coffee to the underlying worldwide price indicator (the Arabica and Robusta futures exchanges.).

The differential price is also expressed in US cents/lb for Arabica and in USD/MT for Robusta. Differentials are quoted by physical trade participants through their offer lists, for nearby and forward positions, and the expected difference between the highest and the lowest quote reflects the different costs and opinions from the various actors.

The general assumption was, and still is, that differential price movements — and hence risk — are considerably less than the underlying coffee price movements. By creating green coffee price differentials, does it become possible to manage price risk more effectively ? Maybe…

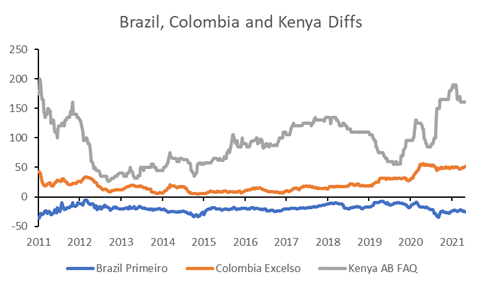

Differentials add another layer of complexity — each quality from each country trades at its own differential — Brazil mainstream naturals tend to trade at a negative differential, Colombia Excelso and Kenya AB FAQ at a positive differential. The simple chart below, focusing on only the most standard quality from each of these three origins, shows how volatile some differentials can trade over time. In the case of Kenya, differential price moves alone can be greater than the level of the underlying futures price.

Tracking coffee country differentials

Differentials principally reflect the origin specific Demand / Supply picture. A larger crop, for example, would tend to put pressure on the differential price, and vice versa. Any form of supply shock — eg. protest and strikes in Colombia or a national election in Uganda — is likely to increase the differential price of that specific origin beyond its borders, although not necessarily within its borders. Currency de/revaluations can also influence differential prices dramatically.

Brazil coffee trees damaged by frost – July ’21

To summarize, the final price of any green coffee consists of the sum of:

- The underlying world coffee price — as quoted by the relevant futures exchange

- Its differential price — as determined by country specific factors

Both can be volatile, although it is generally accepted that, for most coffees, the differential price changes less frequently from day to day.

Volatility and Market Movements

In these weeks following the frost in Brazil, no better time than the present to reflect on the price movements of the last 40 years — and their underlying reasons — to appreciate the historic challenges at both ends of the coffee value chain.

Green coffee pricing chart – 1979 – 2021

Looking back at the history, severe climate events such as frost and drought across Brazil have led to significant coffee price increases. The recent events are no exception. However, the current price situation is more complex and unique extending beyond Brazil, we can’t recall a similar situation with the current combination of events happening in the past:

- Drought, followed by frost, followed by potential additional drought in Brazil: after two back to back episodes of frost in July, the country is now awaiting rainfall from September to November in order to bring about blossoming. Parts of the arabica growing regions in Sul Du Minas and Mogiana were already impacted by a harsh drought which began from October last year impacting the current crop (which has now finished it’s harvest period), while the damage caused by frost has had an impact on the coffee trees that will be harvested in May next year. The damage from the frost can be very visible immediately as farmers usually start to prune and stump severely impacted trees. However, in the medium term the total damages of both drought and the frost combined are noticeable only after the flowering occurs — which may see further pruning and tree stumping taking place if the blossoms fail. Brazil now needs good rains to end November. Without rains to encourage flowering and then also timely follow up rains to “set” the flowering, coffee agronomists expect a serious loss to next year’s harvest potential, which is an “on-cycle” crop. The more erratic the rainfall the poorer the flowering and ‘set’, and hence the more volatile the upcoming price movements.

- The adverse weather situation in Colombia: As the second largest producer of Arabica coffee worldwide, Colombia is facing a complex situation — somewhat opposite to that in Brazil’s arabica growing regions. The weather across Colombia’s coffee growing regions have faced above average rainfall preventing adequate heat stress on the trees which is requisite to a good flowering. Less flowers essentially mean less cherries. Added to the internal crisis that the country experienced some months ago, where strikes and road closures affected coffee exports, disrupted and reduced coffee supply feeds price volatility.

- Mild Arabica deficit overall: Many East-African and Central American coffee producing origins have seen little investment in production over the past three years due to years of low coffee prices. This, together with off-cycles in several origins, will result in a statistical deficit of Mild Arabica in the coming season.

The futures price exchange reacts to the events effecting supply and demand, especially in the world’s largest producing countries. When the supply outlook is below expectations or simply disappointing, underlying prices appreciate. While the frost in Brazil has come and gone and the damage is more or less evaluated, the coffee market is heavily dependent on good flowering across Brazil to compensate for the upcoming Mild Arabica deficits. With so much uncertainty and weather playing such a key role, coffee prices will almost certainly remain firm and very volatile.