Coffee production in Tanzania is thriving. As one of the largest countries in Africa, Tanzania produces as much coffee as its better-known neighbor, Kenya. But an ever-changing political climate and trade policy have left Tanzanian coffee in the shadow of the countries it borders.

Together with Taylor Winch Tanzania (TWT), Genuine Origin’s sister company, we have been working on strengthening direct relationships with cooperatives to develop Tanzanian specialty coffee into outstanding options in our Tanzania portfolio.

Tanzanian coffee farmer

Tanzanian Coffee History

Oral history traces coffee’s role in Tanzanian culture back to the 16th century to the Haya tribe. The northwestern people brought coffee from Abyssinia (modern-day Ethiopia) and used it in cultural functions like tributes and religious rituals, elevating the crop’s status as an important symbol. Amwani, as it was called then, was a Robusta variety, and the Hayas carefully controlled its cultivation to increase its rarity and value.

It wasn’t until the 19th century, when Germany colonized East Africa, that laws were enforced to spread coffee farming further throughout the region as a means to govern and control the Haya people. When Britain came to power post-WWII, coffee operations in the north grew exponentially, centralizing milling and sales in the Moshi municipality near ideal Arabica growing regions on Kilimanjaro, Arusha, and more. By the late 1900s, coffee production spread to the south, which makes up around 80% of the total coffee volume produced today.

Historical reforms to coffee production in Tanzania have significantly impacted the high-priority export crop — sometimes for the better, at times for the worse. From German to British colonization, to government regulation post-independence, and finally to privatized reform in the 1990s, coffee export in Tanzania saw drastic ups and downs in efficiency and valuation before settling into the co-op and auction system currently in place now.

The auction system is well-meaning. At the time of its inception, the government believed auctioning coffee would make Tanzanian coffee more accessible to European buyers while increasing the competitiveness and appeal of the country’s coffee industry abroad.

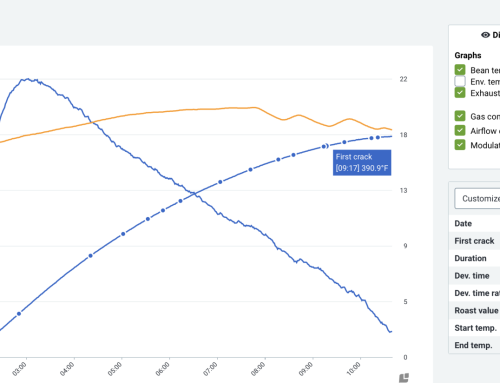

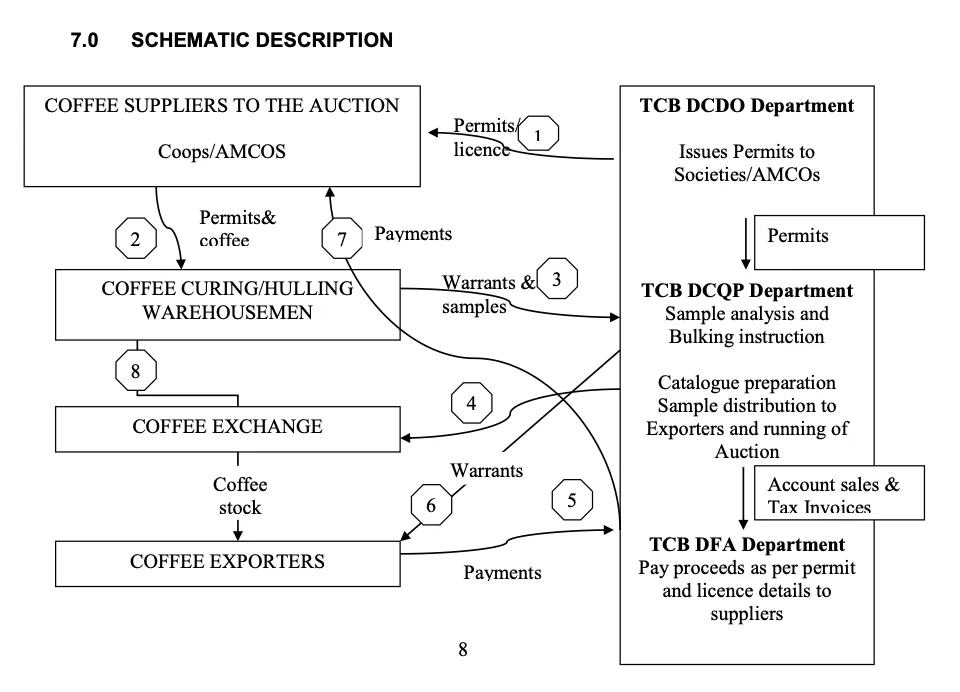

The Tanzania Coffee Board manages the Moshi Coffee Exchange. It’s a complex system full of bureaucratic inefficiencies, as illustrated in the schematic diagram below, taken from the “Trading Manual for Coffee Auction Market.”

Schematic diagram of how coffee is traded in Tanzania

Coffee is milled two to three weeks before the auction. By the time it’s ready to be shipped, the auctioned Tanzania green coffee could be three months old. When coupled with less-than-ideal storage conditions at the Port of Dar es Salaam, the coffee that reaches buyers’ hands is often of deteriorated quality.

The port conditions are like those of any origin country (hot and humid), but the main difference is that exporters and warehouses are also located in Dar es Salaam. When exporters bring coffee to port and try to sell it, they go through the whole inefficient bureaucratic system, so the coffee stays in port for months, which is devastating for quality.

After the government liberalized the coffee trade in 1994, allowing traders to buy cherry directly, the industry experienced vast improvements in processing capacity, marketing efficiency, and agricultural investments. Today, cooperatives and producers compete for the best prices by focusing on quality.

Hand sorting washed coffee at coffee mill in Tanzania

Tanzanian Coffee Production

There are two ways to market coffee in Tanzania: through the central auction or direct export, where exporters like Taylor Winch Tanzania (TWT) buy coffee from producers through their co-op. Since 1993, TWT has grown to be a leading exporter of Arabica coffee in Tanzania, and 30% of their coffee comes directly from their co-op partners. For an exporter to get government approval to initiate a contract with a co-op, they must guarantee they will purchase coffee at a price that’s higher than the coffee auction.

Agricultural Marketing Cooperative Societies (AMCOS) manage 95% of coffee production in Tanzania, with the remaining 5% produced in large, well-capitalized estates in the north. Smallholder farmers must be registered in an AMCOS to gain access to the market and support for production, processing, storage, transport, marketing, and government aid.

Tanzania is a vast country with a wide range of terroir. Chocolate and caramel notes permeate coffee from Kilimanjaro in the north, and citric acidity shines through coffees from southern regions like Mbeya. Mbinga has risen to the top in terms of Arabica production, and its mild coffee is known for its sweet berry notes and hints of chocolate. Peaberry coffee is one of Tanzania’s specialties, and demand for the elusive mutation is high, especially Peaberry coffees from Kilimanjaro.

Tanzanian coffee farmers processing coffee at home

The United States Department of Agriculture (USDA) predicts Tanzania’s green coffee production will grow at one of the world’s fastest rates. In 2018, the Tanzanian government encouraged distribution of high-yielding Arabica seedlings to replace older varieties. Now, the 2023/2024 harvest coincides with the most productive period of these trees in their three-year cycle, and the USDA forecasts a huge 21% increase in production volume to 1.35 million bags of coffee. Around 750 million bags of that are Arabica, while the rest are Robusta.

The harvest period for coffee in Tanzania begins in July and can extend all the way until December. Around 6-7% of the country’s population earns their income from the coffee industry, and approximately 40% of Tanzania’s agricultural farmers grow the cash crop. Most farms are less than a hectare, with around 380 to 2,000 coffee trees. About 95% of Tanzania’s green coffee is produced by around 320,000 smallholder families, while the remaining 5% is produced on around 110 large estates.

In 2022, the government also distributed 3 million free Robusta seedlings to renew older trees. The total harvest area in Tanzania hasn’t changed in recent years and remains stable at 265,000 hectares due to most producers focusing on improving yield over expanding land. However, rising fertilizer prices, poor agricultural practices, and limited access to credit continue to hold Tanzania back from reaching full production potential, problems that exporters like TWT are taking into their own hands by providing financing solutions and agronomy support.

Tanzanian Robusta coffee farmer

Common Tanzania Green Coffee Varieties

Bourbon and Kent are the typical varietals grown in Tanzania. However, the twin threats of coffee berry disease and leaf rust constantly loom over coffee farms throughout Africa. Taylor Winch Tanzania (TWT) estimates that around 20% of the coffee trees die every year because of coffee berry disease. The only solution is to cut the affected parts of the tree and let them grow again. Thus new, compact hybrid varietals are being developed by the Tanzania Coffee Research Institute.

TWT has supplied over 100,000 new seedlings of the disease-resistant compact variety to their partnering AMCOS. Our team has seen a staggering difference. The new variety appears resilient and its disease resistance is amazing.

Coffee trees at the foothills of Mount Kilimanjaro – famous for Kilimanjaro Peaberry

Tanzania Peaberry Coffee

Peaberry coffee is a result of a genetic mutation where only one seed develops inside a coffee cherry instead of two. Peaberries are usually smaller, denser, and rounder than regular coffee beans. Around one in nine coffee cherries result in a peaberry, so patient sorting is required to find them. Many of these painstakingly sorted lots come from the Mount Kilimanjaro and Meru regions. The primary destination for these lots are Japan and the U.S.

Floating coffee cherries for quality at a wet mill in Tanzania

Tanzania Green Coffee Producing Regions

Arabica coffee grows in three regions: in the north on Mount Kilimanjaro’s slopes and the southern regions of Mbeya and Mbinga, often intercropped under the shade of banana trees. Although Tanzania has made a name for itself with Kilimanjaro coffee, only 25% of Arabica production originates from the mountain range. These days, 75% of Arabica is coming from the south of Tanzania. Our team believes that the southern regions have more potential for growth in volume. Farmers in the south are younger and more energetic. It’s the opposite in the north.

The Northern Highlands of Arusha, Mount Kilimanjaro, Mount Meru, and Pare range from 1,250 to 1,400masl. The climate is cooler, with abundant rainfall and volcanic soil.

The West Lakes by Lake Victoria and Lake Tanganyika border Burundi and Rwanda, where coffee first entered Tanzania via the Haya tribe. The bulk of Tanzania’s Robusta production comes out of Bukoba, Kagera, Manyara, and Muleba, from altitudes of 1,200 to 1,400masl.

The Southern Highlands of Songwe, Ruvuma, Mbeya, and the Matengo Highlands border Lake Malawi at 1,200 to 1,800masl. The high altitude and fertile, non-volcanic soil lend to distinctly fruity, floral, and medium-bodied flavor profiles.

The cupping lab at Taylor Winch Tanzania

Tanzania Green Coffee Quality Grading

Tanzania employs its own coffee grading system, which shares similarities with the one used in Kenya, that factors in species, bean size, density, processing method, and cup characteristics. The scale ranges from AA (screen sizes 17 & 18, AB (15 & 16), C (14 & 15), and PB for peaberry – a highly coveted classification for Tanzania green coffee beans.

Genuine Origin in Tanzania

All coffee sourced by TWT for Genuine Origin is through direct export and purchased in parchment from partner AMCOS groups. Washed coffee accounts for nearly all of the Arabica exports, but Genuine Origin has been able to source very desirable natural processed Tanzania coffees. Cherries are typically processed at the farm level or coffee production units (CPUs) before the coffee is sent to a dry mill like TWT’s Rafiki Mill in Moshi, Kilimanjaro. At the mill, the coffee is graded, packed, and prepared for export.

TWT’s mission is to be “as close as possible to the farmer and to the client,” a philosophy executed in their five-star service and support to both sides of the value chain. The services they provide span everything from due diligence to certification support and include training in agronomy, leadership, education, and more. TWT not only plays an essential role in adding value to coffee production; it is also a bridge between an AMCOS and its producer members on a district level and an AMCOS with regulatory and research institutions on a national level.

TWT prides itself on the quality of support it can provide to clients and AMCOS partners alike. Once they decide to partner with an AMCOS, TWT provides financial support – in particular, micro-loans that are granted before harvest that enable producers to buy fertilizer and pesticide for their trees. The cash loans also help to repair washing stations where fermentation occurs. TWT also provides education at the processing level. Processing and fermentation can make or break quality.

As TWT strengthens its relationships with AMCOS and private estates, they are building the capacity to conduct more coffee-processing experiments. Coffee roasters can expect continuing improvements in quality from carefully curated co-ops in Genuine Origin’s Tanzania portfolio.